NEW OPPORTUNITY -

Prosper Way

Columbia, SC

*Accredited Investors Only

NEW OPPORTUNITY -

Prosper Way, Columbia, SC

*Accredited Investors Only

INVESTMENT HIGHLIGHTS

- 18% Projected Returns - Equity Partners will benefit from a preferred return as high as 8% and projected annualized returns of 18%

- 419 Units - Prosper Fairways is a 419 unit garden style apartment community located in Columbia, SC and is less than 3 miles from downtown.

- Negotiated Sale Price $4.8MM Under Market Value - We negotiated a purchase price that is $4.8MM under market value in one of the fastest growing cities in the Country.

INVESTMENT HIGHLIGHTS

- 18% Projected Returns - Equity Partners will benefit from a preferred return as high as 8% and projected annualized returns of 18%

- 419 Units - Prosper Fairways is a 419 unit garden style apartment community located in Columbia, SC and is less than 3 miles from downtown.

- Negotiated Sale Price $4.8MM Under Market Value - We negotiated a purchase price that is $4.8MM under market value in one of the fastest growing cities in the Country.

WHY INVEST WITH US?

$236MM

current portfolio value

22.71%

Avg. Projected ARR

2,589

units under management

10.43%

average COC

34.3%

Avg. Actual ARR*

$38,906,679

equity created

WHY INVEST WITH US?

$236MM

current portfolio value

26.42% Avg. Returns

on previous deals we've managed

2,589

units under management

10.43%

average COC

79.28%

average ARR*

$38,906,679

equity created

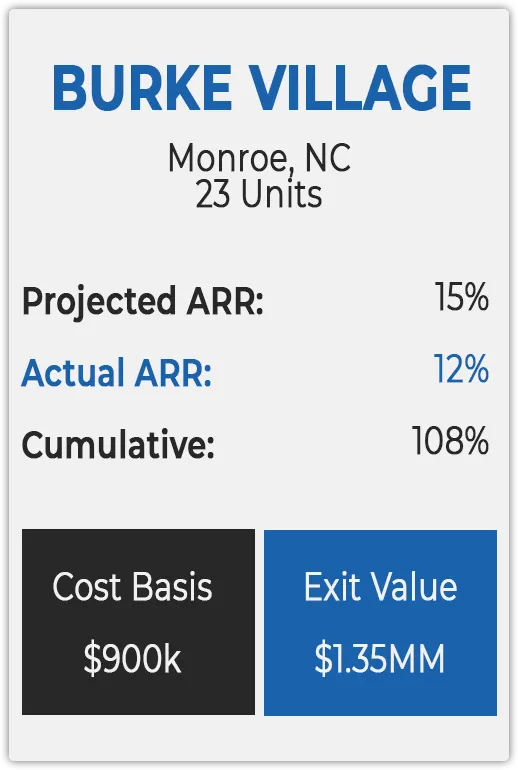

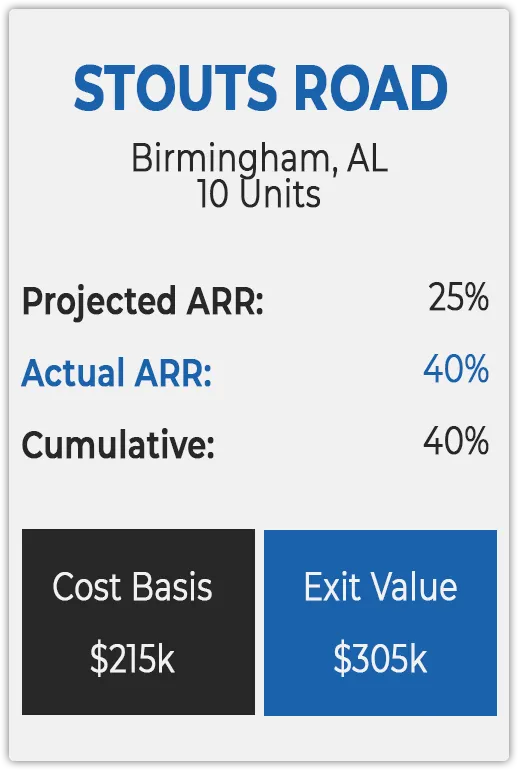

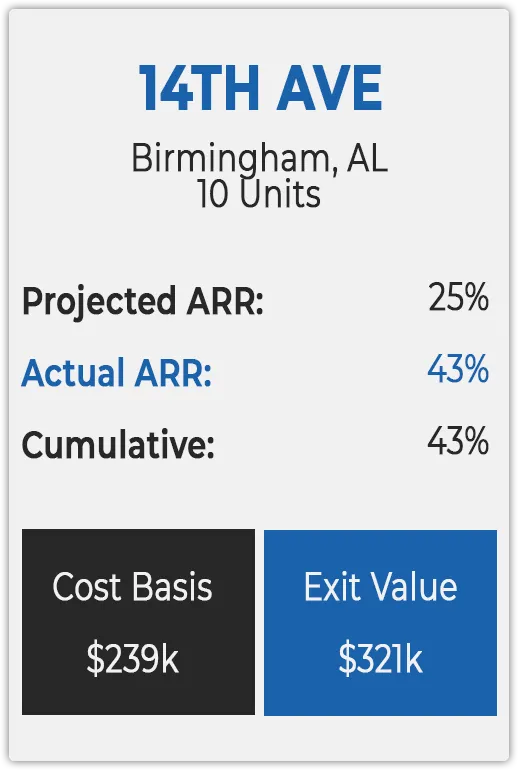

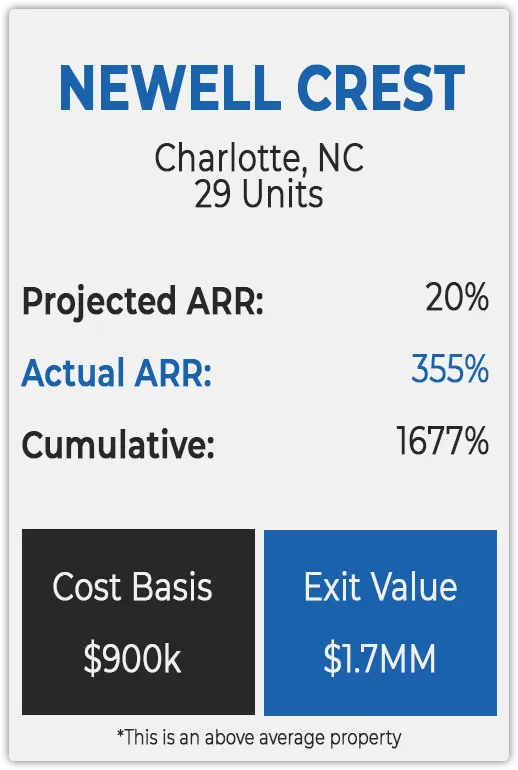

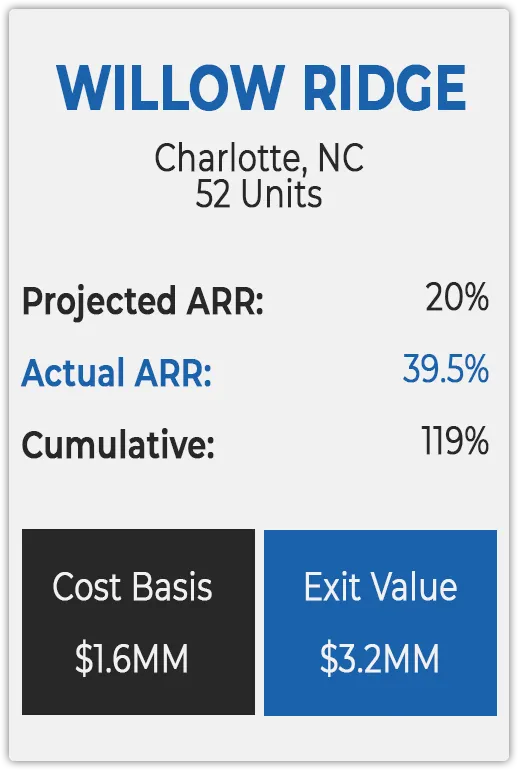

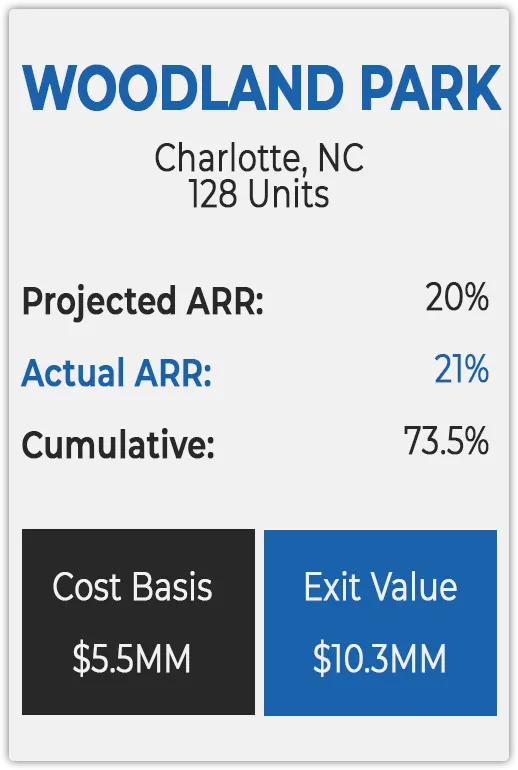

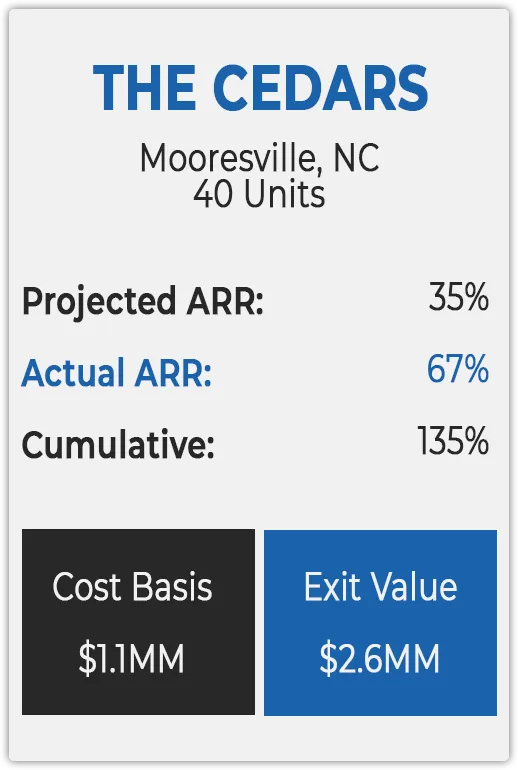

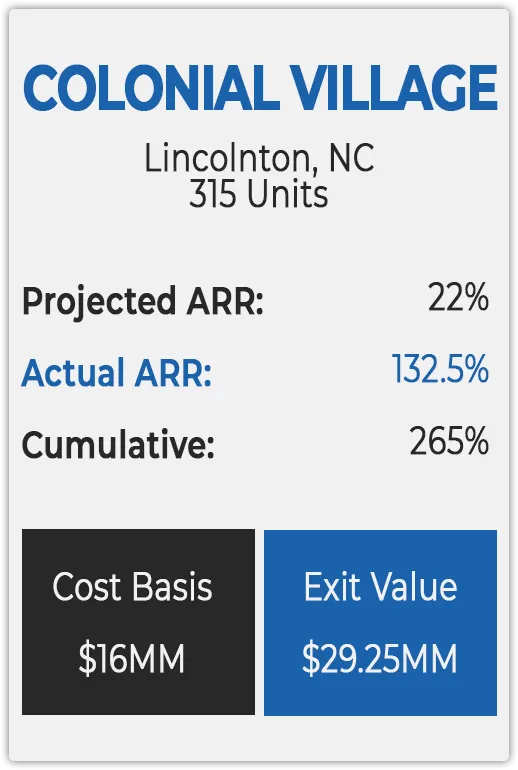

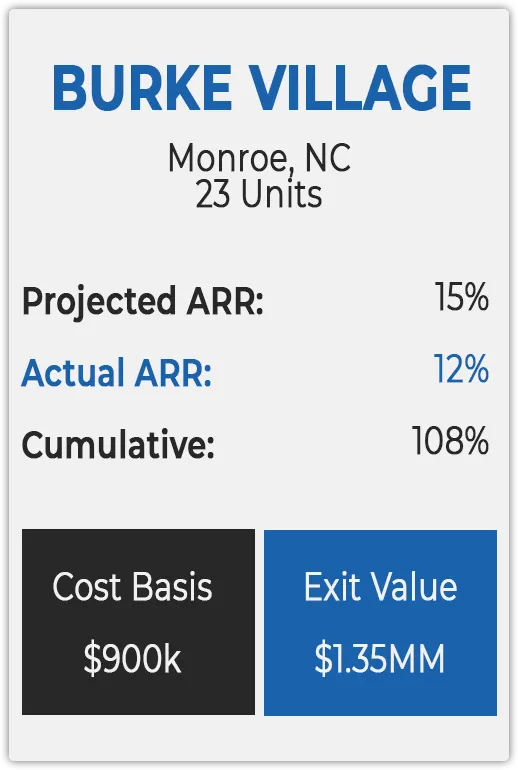

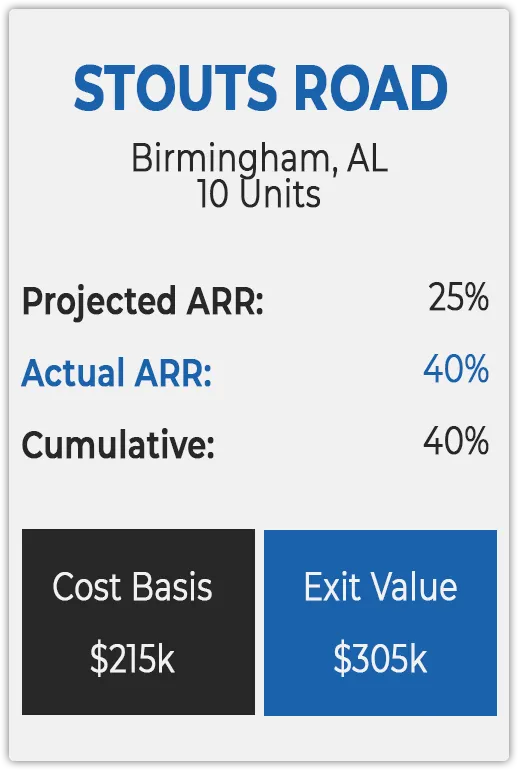

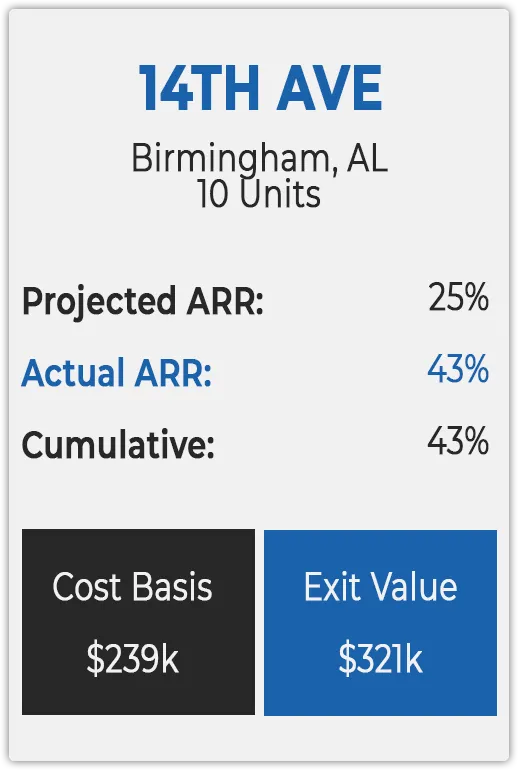

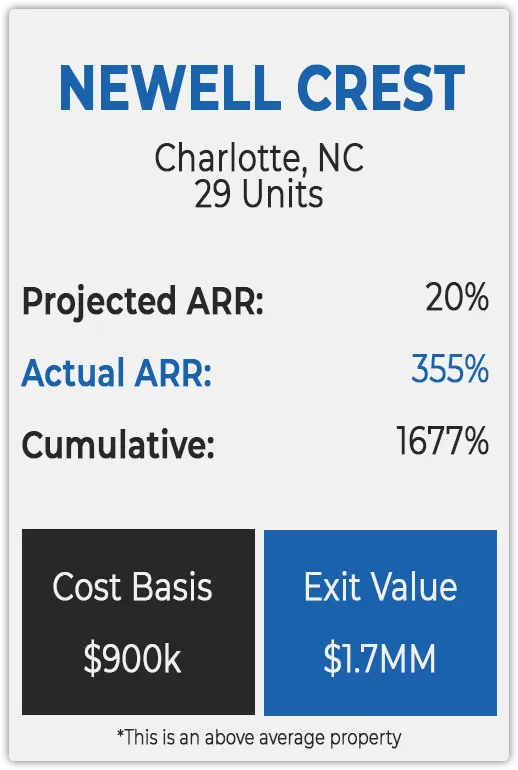

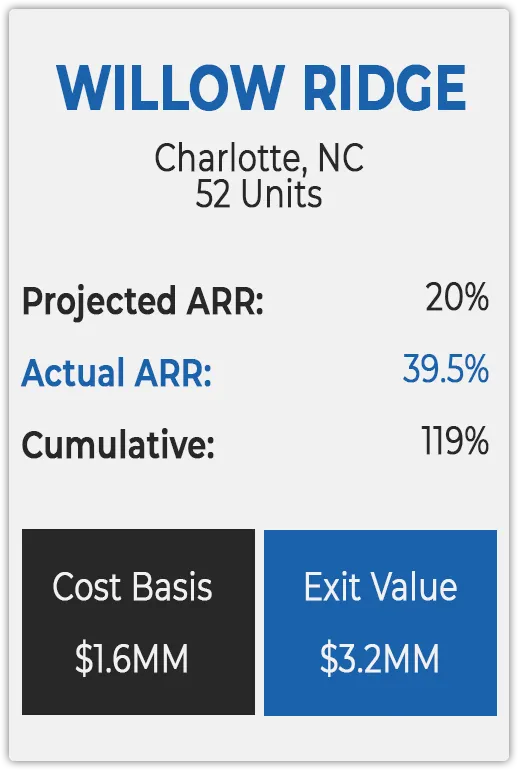

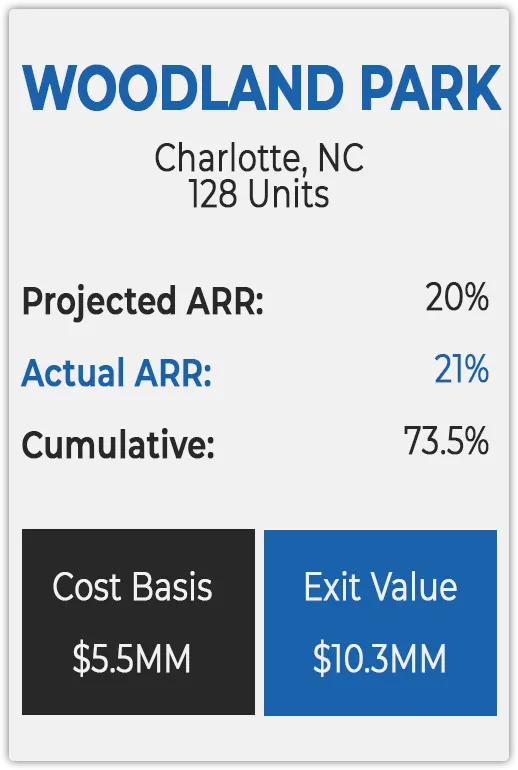

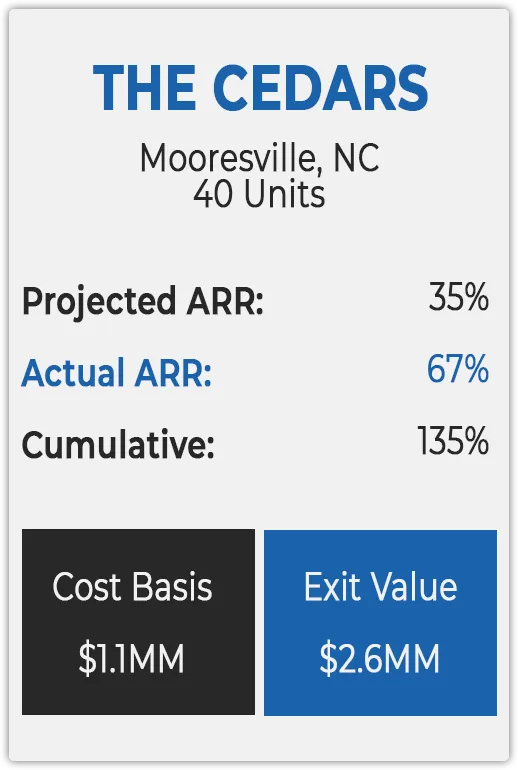

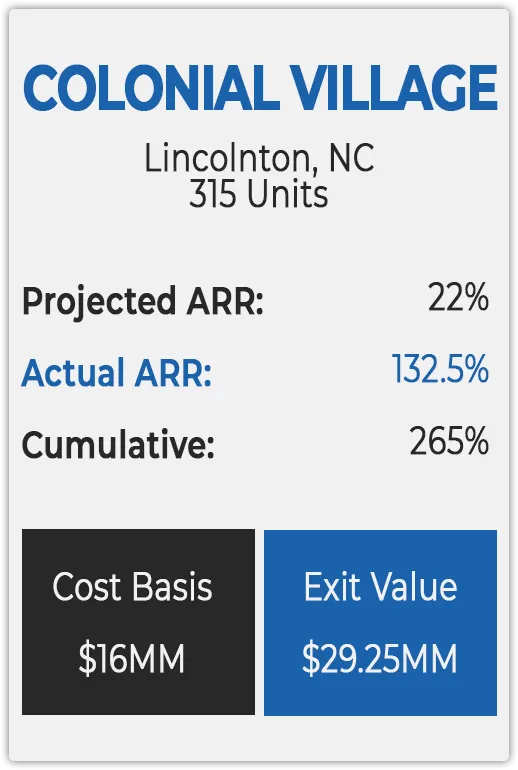

PAST INVESTMENTS

PAST INVESTMENTS

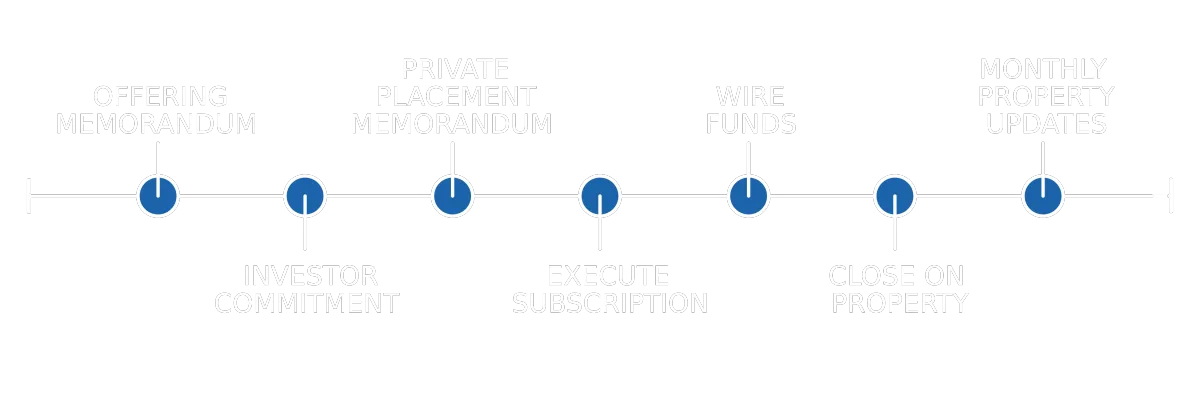

OUR TIMELINE

OUR TEAM

Tyler Deveraux

Managing Partner

Tyler Deveraux is the managing partner of MF Capital Partners, a privately held, multifamily investment company, and has been investing in real estate for over 14 years. At the age of 21, he acquired his first student rental property, quickly understood the potential of the industry, and never looked back.

Today, Tyler controls over 1,500 apartment units, throughout 5 different states, with values north of $100 Million.

Tyler is also the Co-Founder & CEO of The Multifamily Mindset, an education company that provides new & seasoned investors with the training and support they need to acquire multi-family properties. Tyler has trained 1,000’s of new and seasoned investors to acquire multi-family properties, maintain a positive growth mindset, and live a rich, full life. Teaching, inspiring, and helping others is Tyler’s true passion.

Tyler now lives in Maui, HI with his wife Brittany & their two beautiful kids Paxton & Marley.

Melissa Forbush

Managing Member

Melissa Forbush is a managing member of MF Capital Partners, a privately held, multifamily investment company. Melissa’s passion for people originated in emergency nursing, and evolved into providing passive, high yield income for investors.

As a mother of 4, Melissa has had to be a strategic thinker finding tactical solutions on a daily basis. She brings these transferable skills into her role in Investor Relations.

Melissa is also the Chief Information Officer of The Multifamily Mindset, an education company that provides new & seasoned investors with the training and support they need to acquire multi-family properties. Melissa has mentored many new and seasoned investors helping them acquire multi-family properties. Her true passion is people. Whether you’re a current investor or a new student starting to learn the ropes, that passion runs deep.

Ryan Woolley

Managing Partner

The benefits of multifamily were realized at a young age for Ryan as he watched his grandfather acquire apartments throughout Sacramento. His biggest takeaway was the quality of life those assets provided and the legacy his grandpa was able to leave behind because of them.

Ryan took that vision, acquired a degree in accounting from Utah Valley University, and has used that knowledge to start and maintain a successful real estate business. What began with a focus on single family flips has now evolved into a portfolio of multi family assets spanning over 4 different states.

Over the past 20 years Ryan has become a proficient underwriter which has been critical in mitigating risks, identifying opportunities, developing strategic operating plans, and optimizing overall investor returns. Ryan now lives in Orlando, FL as a single dad of two boys, creating a legacy of his own, and helping others do the same.

Zach Rucker

Underwriting Specialist

Brady Barker

Due Diligence

Jake Dean

Team Buildling

Hunter Gascay

Acquisitions

Tasha Allred

Investor Relations

Zach Rucker

Underwriting Specialist

Brady Barker

Due Diligence

Jake Dean

Team Buildling

Hunter Gascay

Acquisitions

Tasha Allred

Investor Relations

WHY REAL ESTATE

CASHFLOW

After all expenses are paid, quarterly distributions go out to investors.

STABILITY

Multifamily is less volatile and continues to outperform traditional stock based investments.

TAX BENEFITS

Depreciation is a tax write-off that enables you to keep more of your profits.

LEVERAGE

You can leverage real estate, this allows you to buy a $10M property with only $2.5M.

AMORTIZATION

Residents pay down debt which creates equity, this leads to long-term wealth.

APPRECIATION

Forced appreciation through strategic value plays increase the overall value of the property.

WHY REAL ESTATE

CASHFLOW

After all expenses are paid, quarterly distributions go out to investors.

STABILITY

Multifamily is less volatile and continues to outperform traditional stock based investments.

TAX BENEFITS

Depreciation is a tax write-off that enables you to keep more of your profits.

LEVERAGE

You can leverage real estate, this allows you to buy a $10M property with only $2.5M.

AMORTIZATION

Residents pay down debt which creates equity, this leads to long-term wealth.

APPRECIATION

Forced appreciation through strategic value plays increase the overall value of the property.

No Offer of Securities—Disclosure of Interests Under no circumstances should any material at this site be used or considered as an offer to sell or a solicitation of any offer to buy an interest in any investment. Any such offer or solicitation will be made only by means of the Confidential Private Offering Memorandum relating to the particular investment. Access to information about the investments are limited to investors who either qualify as accredited investors within the meaning of the Securities Act of 1933, as amended, or those investors who generally are sophisticated in financial matters, such that they are capable of evaluating the merits and risks of prospective investments.

© 2021 Copyright, Multi Family Capital Partners